Tuesday, December 30, 2014

What demographics-related issues do you think are being underreported?

Any number of demographic issues around the world have been heavily reported on: population aging, fertility change, population shrinkage in some countries and continued growth in others, continued changes in family formation. Speaking as a news junkie, issues of demographic change have been raised in connection to many different countries, whether we're talking about depopulation (or not) in the former Soviet Union, economic problems in countries as diverse as Japan, Germany, and the United States, and issues of unauthorized migration across frontiers.

Are there any issues that you think have been underreported? Are there any regions of the world where significant developments have been, you think, overlooked?

Leave suggestions in the comments. Again, the readership of Demography Matters matters.

Sunday, December 28, 2014

Suggestions, feedback, comments? Leave them here.

Before I start posting tomorrow about China, I thought I'd create a space here at Demography Matters for commenters to leave suggestions and feedback. What our readers are interested in matters to us.

Tuesday, December 23, 2014

Notes on the demographic future of Cuba

In the past, Demography Matters has examined the demographic issues of Cuba at some length. In a August 2006, I noted that all of the predictions for Cuba expected rapid aging of the population, as a consequence of low fertility and sustained emigration, leading to substantial shrinkage of the country's workforce. In a July 2009 post, I noted that the Cuban population had already begun to shrink, and in a May 2010 post I argued that Cuba was missing too many opportunities for change, too many windows closing while it still had a relatively young population. The post-Communist example of Bulgaria was something I raised in 2006, with its spectre of incipient depopulation and the pre-existing example of massive Cuban emigration to the United States. Nothing that has happened since has convinced me this is not a plausible future for Cuba.

And now? Some of the announced changes by the United States, particularly the expanded volume of remittances that can be sent to Cuba by migrants and increased ease of movement and communication across the Florida Straits, might make provide greater incentives for migration. As a November 2014 Havana Times article noted, in the two decades after the Cold War a half-million Cubans emigrated to the United States. Why not more, if nothing else changes in Cuba?

I suspect that Cuba might not be coming to the last of its opportunities to get rich before it grows old. Will Cuba manage this transition in a new era of improved Cuban-American relations? One can only hope.

UPDATE: Marginal Revolution's Tyler Cowen argues that there are good reasons, including a vulnerable export sector, institutional weaknesses, and brain drain, to be skeptical of post-Communist Cuba's economic chances. (He also lists some reasons for hope, including high levels of human development, abundant natural resources, and a talented diaspora in the United States.)

Friday, December 19, 2014

One note on the global revolution in longevity

A recent Bloomberg article, Dani Bloomfield's "It’s the Best Time to Be Born as Life Expectancy Tops 70", caught my eye.

These are good times to be a baby. A child born last year will live six years longer on average than one born in 1990, the first time in history that life expectancy worldwide extends past age 70.

Much of the gain has come from poor countries, where better health infrastructure has helped people live dramatically longer lives, according to a paper published today in the journal Lancet. In rich countries, new drugs and other advances are stretching lifetimes, the study’s authors said.

Eastern sub-Saharan Africans saw a 9.2-year gain in life expectancy between 1990 and 2013, the biggest increase of any region. In some countries, such as Rwanda, Nepal, Niger and Iran, the outlook increased by more than 12 years.

“Outside of Southern Africa there’s been quite substantial improvement in life expectancy everywhere,” said Christopher Murray, the study’s lead author and a professor at the University of Washington, in Seattle. Except for 1993, when the worldwide estimate was hurt by genocide in Rwanda, “you can see that global life expectancy, particularly since 2000, has been going up 0.3 of a year, every single year.”

Worldwide, the expected length of life for an infant born last year grew 6.2 years, to 71.5 years old, according to the study, which was sponsored by the Bill & Melinda Gates Foundation.

The paper in question, "Global, regional, and national age–sex specific all-cause and cause-specific mortality for 240 causes of death, 1990–2013: a systematic analysis for the Global Burden of Disease Study 2013", is available in its entirety online.

Global life expectancy for both sexes increased from 65·3 years (UI 65·0–65·6) in 1990, to 71·5 years (UI 71·0–71·9) in 2013, while the number of deaths increased from 47·5 million (UI 46·8–48·2) to 54·9 million (UI 53·6–56·3) over the same interval. Global progress masked variation by age and sex: for children, average absolute differences between countries decreased but relative differences increased. For women aged 25–39 years and older than 75 years and for men aged 20–49 years and 65 years and older, both absolute and relative differences increased. Decomposition of global and regional life expectancy showed the prominent role of reductions in age-standardised death rates for cardiovascular diseases and cancers in high-income regions, and reductions in child deaths from diarrhoea, lower respiratory infections, and neonatal causes in low-income regions. HIV/AIDS reduced life expectancy in southern sub-Saharan Africa. For most communicable causes of death both numbers of deaths and age-standardised death rates fell whereas for most non-communicable causes, demographic shifts have increased numbers of deaths but decreased age-standardised death rates. Global deaths from injury increased by 10·7%, from 4·3 million deaths in 1990 to 4·8 million in 2013; but age-standardised rates declined over the same period by 21%. For some causes of more than 100 000 deaths per year in 2013, age-standardised death rates increased between 1990 and 2013, including HIV/AIDS, pancreatic cancer, atrial fibrillation and flutter, drug use disorders, diabetes, chronic kidney disease, and sickle-cell anaemias. Diarrhoeal diseases, lower respiratory infections, neonatal causes, and malaria are still in the top five causes of death in children younger than 5 years. The most important pathogens are rotavirus for diarrhoea and pneumococcus for lower respiratory infections. Country-specific probabilities of death over three phases of life were substantially varied between and within regions.

Causes of mortality, the authors suggest, are shifting globally away from communicable diseases towards non-communicable diseases and injuries.

This news item put me in mind of a 2010 post I made about the grim demographics of the Roman Empire, and by extension almost all other pre-modern societies of note. Mortality was by our contemporary standards terrifyingly high, especially high in the early lives of human beings, to an extent that even the least developed societies in our 21st century world would have difficulty comprehending. That world life expectancy is now comparable to that of Canada in the 1960s is a remarkable transformation without precedent, and something quite worth watching.

Thursday, December 18, 2014

On looking at peripheries

For the next little while here at Demography Matters, I'll be posting examinations of various lengths about the demographic dynamics of peripheries, territories and populations both. Part of my reason for this has to do with my own personal interests in the topic, coming from a relatively marginal area of Canada myself. Relationships between peoples and individuals and regions located in the core and periphery and semi-periphery, to borrow the language of world-systems theory, have always interested me, especially as these relationships change.

More of my interest has to do with the ways in which this division of the world is starting to have real consequences for population change. As the distribution of human and economic capital changes, becoming scarce in some parts of the world and more abundant in others, with some being united by borders and others being cut off, real tensions do develop. This is especially so where things change unevenly. What areas are winners? What areas might catch up? What areas might end up declining?

Stay tuned.

Tuesday, December 16, 2014

On how Afghanistan shows the importance of having a census

A recent article by Joseph Goldstein in The New York Times, "For Afghans, Name and Birthdate Census Questions Are Not So Simple", caught my attention.

Wikipedia's "Demographics of Afghanistan" article notes that, apart from a survey performed in 2009, Afghanistan really has no firm data on demographic trends at all. This, as Goldstein notes, can harm individual lives.

After long delays, false starts and squandered millions in foreign aid, the great Afghan census is finally underway. The process is more than an exercise in counting bodies but one that, officials hope, will head off the kind of voter fraud that plagued the presidential election this past year.

The census teams generally include a man and a woman who often spend considerable time waiting in front of doors that never open, often because of purdah, the custom of sequestering women indoors away from men not their husbands or relatives and requiring a burqa when outside.

[. . .]

Since census workers began knocking on doors in Kabul this year, they have registered 70,000 people — just 2 percent of the city. Optimistic Afghan officials say it will take years before the entire country is surveyed.

“We believe we will reach 70 percent of the population in five years,” said Homayoun Mohtaat, the project’s director.

Nobody knows just how many people reside in Afghanistan. The last census, in 1979, found some 14.6 million people. Afghanistan’s Population Registration Department currently has records for about 17 million Afghan citizens, according to officials.

Each name is listed in a clothbound ledger book stacked on sagging metal racks in four dusty rooms in the offices of the department, a government agency.

For years, this is where citizens have come to seek a passport, join the army or change their marital status. Before that can happen, though, the petitioner’s identity must be verified in one of the books. Clerks say they almost never fail to locate an entry, except for people with the bad luck of being listed on the first or last page. Those names and photos have largely worn away from use over the decades.

The clerks who work here have the carnival-worthy ability to guess a person’s age within a year, a necessity in a place where few actually know how old they are.

Mr. Mohtaat guesses the census will yield a count of 35 million to 40 million Afghans.

As Sune Engel Rasmussen writing in The Guardian noted in the case of Kabul, the lack of firm data makes it difficult for governments and others to get a handle on the country's problems. The case of booming Kabul is the particular focus of Rasmussen's article, but doubtless similar stories could be told about other Afghan cities and regions.

Though exact data is impossible to obtain (the last official census was conducted in 1979), Kabul is estimated to be the fifth fastest growing city in the world, with a population which has ballooned from approximately 1.5 million in 2001 to around 6 million people now. The rapid urbanisation is taking a heavy toll on a city originally designed for around 700,000 people. An estimated 70% of Kabul’s residents live in informal or illegal settlements.Afghanistan has many problems. One particularly important problem, I'd argue, is the lack of firm data about just who is living in Afghanistan and what they're doing. Without good data, many things become difficult. Here's to hoping that Afghanistan succeeds in this particular project.

“The situation is putting a strain on the existing infrastructure and resources – and makes it difficult to ensure security across Kabul,” said Prasant Naik, country director of the Norwegian Refugee Council, which provides legal counselling and shelter to displaced Afghans and is one of the largest humanitarian organisations in Afghanistan.

A significant share of Kabul’s economy is driven by illicit businesses, such as the drug trade, facilitated by corruption. (According to a recent survey by the UN Office on Drugs and Crime, Afghanistan’s opium cultivation hit record levels this year.)

With economic growth slowed from 9% in 2003 to 3.2% in 2014, jobs are scarce and the vast majority of Kabul’s workers are either self-employed or casual labourers.

Tuesday, November 25, 2014

Looking to the science fiction of Monica Hughes and the demographics of the future

Just this week, I've had the occasion to reread prolific Canadian young adult science fiction writer Monica Hughes' 1991 novel Invitation to the Game. I read the book back when it came out in hardcover, as a Grade 6 student on Prince Edward Island, and was impressed. I'm happy to say that the book still holds up as well, that the novel still deserves my warm memories and the awards and good reviews of others. Understandable as a prototype of the dystopias that seem to predominate nowadays in young-adult literature, Invitation to the Game is a novel that I was surprised to find provided an interesting commentary on some of the demographic issues facing us right now.

The novel starts in the year 2154, as the 16-year-old protagonist Lisse and her friends graduate from their elite private school to their jobless adult lives. There had been a population crash in the early 21st century, precipitated by pollution, and of necessity robots were made to take over much of the day-to-day routines of human society. Even after the population recovered, however, the robots remained entrenched, with the net effect of dooming most of each coming generation to unemployment. Two of Lisse's friends are lucky enough to end up employed, for a time. The remainder are exiled with Lisse to live out their lives in a "Designated Area", an urban district to which they are confined by internal passports, depending on stipends from a resentful employed minority and grey-market jobs to live. Without any hope of escaping their condition, the young graduate drift into despair until they are invited to "The Game," a mysterious but detailed virtual reality scenario that allows them to escape to another world. Eventually, they do.

This post is not a ridiculous post about space colonization being a solution to issues of unemployment and underemployment, to marginalization and anomie. Any kind of program of space colonization is no kind of answer at all to these issues. Author Charlie Stross' 2007 essay "The High Frontier, Redux" makes the point that, even if there are economically exploitable resources in space, the optimistic dreams of human settlement are unlikely to be realized because human beings are just too fragile to persist. Many things would have to change radically for this to happen, and we don't even know if these radical changes are possible.

This is, however, a post that's concerned about the ethics of this. In this world, as in Hughes' fictional future world, people are a resource. In many parts of the world, people are an increasingly scarce resource, especially people belonging to particular demographics or possessing certain skills. Despite the value of people as a resource, and despite these local scarcities, in many cases people are being prevented from being useful. This might be because of barriers to migration. This might be because of mistaken government policies that prevent others from realizing their talents. Whatever the precise cause, it's fundamentally ill-thought and--I'd suggest--in many ways quite wrong. As Hughes' characters note, this kind of waste might even be very problematic for the survival of any numbers of regimes.

"[I]t seems the Government's not interested in any new ideas."

"That's the problem with this society," Trent interrupted. It is uninterested. Dead in the water. We should scrap it and start over."

"How?" Karen asked, her big voice booming. "Societies tend to go on until they run down by themselves or rot from inside."

"Can you afford to wait that long?" Trent pushed his sharp face aggressively at Karen. "I can't." (13-14)

When considering demographic issues, now and in the future, it's also worth considering the extent to which particular treatments are, or are not, sustainable. Various marginalizations--keeping people out, keeping people down--might be politically convenient, but they might equally be politically dangerous.

Monday, October 20, 2014

Does The Secular Stagnation Theory Have Any Sort of Validity?

In a number of blog-posts (Paul Krugman's Bicycling Problem, On Bubble Business Bound, The Expectations Fairy) I have examined some of the implications of the theory of secular stagnation. But I haven't up to now argued why I think the hypothesis that Japan and some parts of Europe are suffering from some kind of secular stagnation could well be a valid one.

Strangely, while I would suggest the most obviously affected countries are those mentioned above, most of the debate has centered around the US economy. Since it is not at all clear that the US economy is actually suffering from either a liquidity trap or secular stagnation at this point, this has lead many to question whether the idea might not be ill-founded. The Economist, for example, in a revue article (Vox e-book on the topic conclude the concept "remains a baggy one", one which is "arguably too capacious for its own good".

Viewed in this light the concept does at times appear vague, and lacking in clear definition. In part this is because Alvin Hansen's original idea was made up of two components, a technological and a demographic one. Naturally if there is a slowdown in the rate of impact of technological innovation then this would be felt equally across those economies which are operating near the technological frontier. But the phenomenon which is being described today as secular stagnation isn't being witnessed equally across all those countries. Economies in both the UK and the US appear to have responded differently to those in Sweden, the Euro Area and Japan, a phenomenon which is obvious to the theory's critics. Thus the Economist author goes on to argue, "it is hard to avoid the conclusion that many of the euro area’s difficulties result from a dysfunctional monetary union rather than a susceptibility to secular stagnation." And it would be hard to disagree with the writer, except... except ....except that there is the awkward little case of Japan, which doesn't actually use the Euro, as there are possible cases like the Czech Republic, Sweden or Hungary that don't either.

Which brings us nearer to the demographic part of the argument. Is there any pattern emerging in the way symptoms which look like those which would be presented in cases suffering from secular stagnation are showing up? Well, I would argue there is. I think it is generally accepted that the first affected country was Japan. It was in Japan that a slowdown in GDP growth (not GDP per capita growth) was first noted.

Japan was also the first country were working age population started to turn negative (in 1997) and where the correlation between declining growth momentum in this group and creeping deflation first started to be noticed.

Here's what movements in EU working age population look like.

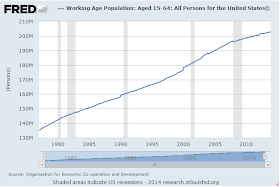

And here's why I don't think considerations of demography can really justify the secular stagnation thesis in the United States context at the present time.

EU working age populations started to decline in the years between 2009 and 2012. They will now continue to decline for many years to come. In the United States however, while the rate of growth in this population segment has slowed in recent years, it is about to start accelerating again. As Calculated Risk's Bill McBride pointed out, the US Census Bureau now reports that Baby Boomers aren't the largest US cohort anymore, and that the prime working-age force is expected to start growing again in a few years. In other words, in terms of the demographic outlook, the dynamic points to stronger, rather than weaker, economic growth. By 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts will be the youngest 11 cohorts. (see the marvelous animation Bill has at the end of his post).

Not All Europe Is The Same

Naturally, demographic dynamics are not the same in every country across Europe. The two oldest countries on the planet are Japan and Germany with median population ages of around 46. Then comes Italy with with one of 45. I have recently written about the possibility Germany is bogged down in some kind of secular stagnation process. The Economist writer argues that what Europe's economies need are structural reforms, but it isn't clear if he also thinks Germany needs another swathe of these. Long term growth is low in Germany, and inflation pressures are weak. It is not clear, however, that Germany is stuck in any kind of any kind of balance-sheet-recession-type liquidity trap. Loan growth is low, but this may well be a function of the age structure of the population.

It's no big secret really that Italy is suffering long term growth stagnation (which many, like the Economist and Beppe Grillo simply attribute to Euro membership).

And Italy has recently begun to have negative inflation levels.

Next on the list come countries like Austria (median age, 44), Finland (43,2), The Netherlands (42.1), Switzerland (42) and Sweden (41.2). It is striking that both Finland and The Netherlands have recently been suffering from very weak growth and almost constant recessions, while Sweden and Switzerland have an ongoing problem with a deflation threat.

If we fan out a bit, and move over to Eastern Europe, where working age populations are almost universally falling, the sharp fall in growth rates between the years before and the years after the crisis is also pretty noteworthy.

Before the crisis annual growth rates were in the 4% to 6% range, now they are in the 1% to 2% range, and these are all emerging economies with levels of GDP per capital well below the EU average, countries who should in theory be experiencing strong "catch up" growth.

At the same time inflation, which was previously a significant problem, has all but disappeared and in fact deflation risk is pretty general across the region. Normally CEE countries have median ages of around 41, much older than say Ireland with a median age of 35.7, or the United States with one of 37.6.

So we seem to be observing the following pattern: working age population growth approaches zero and starts to turn negative, growth slumps to about 1% a year and falling, and inflation weakens to the point of becoming deflation. If this rough correlation is reasonably valid the next countries where we see secular stagnation setting in are South Korea and China, since working age populations are now in the process of turning there too.

A Simple Mechanism

So how do secular stagnation work? What's the mechanism? Well so far we have been offered two, one from Paul Krugman.

Then we have seen it in Germany.

And now the "German" phenomenon has spread to the rest of Europe.

The second pathway through which demographically driven secular stagnation operates was described by a group of IMF economists in a recent research paper: "Is Japan’s Population Aging Deflationary?" Lower demand from older populations (less credit growth) leads to oversupply and deflationary pressure. The first part of the paper abstract runs as follows:

"Japan has the most rapidly aging population in the world. This affects growth and fiscal sustainability, but the potential impact on inflation has been studied less. We use the IMF’s Global Integrated Fiscal and Monetary Model (GIMF) and find substantial deflationary pressures from aging, mainly from declining growth and falling land prices. Dissaving by the elderly makes matters worse as it leads to real exchange rate appreciation from the repatriation of foreign assets. The deflationary effects from aging are magnified by the large fiscal consolidation need."

So while there is no definitive answer at this point to the question whether or not what we are seeing is a creeping process of secular stagnation which will gradually spread from one economy to another as the respective working age populations start to contract, there is strong prima facie evidence that there may be, that the theory is worth examining and that the hypothesis should continue to be tested.

Postscript

The above arguments about why the Euro Area countries may have entered some sort of state of secular stagnation are developed in detail and at far greater length in my new book "Is The Euro Crisis Really Over? - will doing whatever it takes be enough" - on sale in various formats - including Kindle - at Amazon.

Strangely, while I would suggest the most obviously affected countries are those mentioned above, most of the debate has centered around the US economy. Since it is not at all clear that the US economy is actually suffering from either a liquidity trap or secular stagnation at this point, this has lead many to question whether the idea might not be ill-founded. The Economist, for example, in a revue article (Vox e-book on the topic conclude the concept "remains a baggy one", one which is "arguably too capacious for its own good".

Viewed in this light the concept does at times appear vague, and lacking in clear definition. In part this is because Alvin Hansen's original idea was made up of two components, a technological and a demographic one. Naturally if there is a slowdown in the rate of impact of technological innovation then this would be felt equally across those economies which are operating near the technological frontier. But the phenomenon which is being described today as secular stagnation isn't being witnessed equally across all those countries. Economies in both the UK and the US appear to have responded differently to those in Sweden, the Euro Area and Japan, a phenomenon which is obvious to the theory's critics. Thus the Economist author goes on to argue, "it is hard to avoid the conclusion that many of the euro area’s difficulties result from a dysfunctional monetary union rather than a susceptibility to secular stagnation." And it would be hard to disagree with the writer, except... except ....except that there is the awkward little case of Japan, which doesn't actually use the Euro, as there are possible cases like the Czech Republic, Sweden or Hungary that don't either.

Which brings us nearer to the demographic part of the argument. Is there any pattern emerging in the way symptoms which look like those which would be presented in cases suffering from secular stagnation are showing up? Well, I would argue there is. I think it is generally accepted that the first affected country was Japan. It was in Japan that a slowdown in GDP growth (not GDP per capita growth) was first noted.

Japan was also the first country were working age population started to turn negative (in 1997) and where the correlation between declining growth momentum in this group and creeping deflation first started to be noticed.

Here's what movements in EU working age population look like.

And here's why I don't think considerations of demography can really justify the secular stagnation thesis in the United States context at the present time.

EU working age populations started to decline in the years between 2009 and 2012. They will now continue to decline for many years to come. In the United States however, while the rate of growth in this population segment has slowed in recent years, it is about to start accelerating again. As Calculated Risk's Bill McBride pointed out, the US Census Bureau now reports that Baby Boomers aren't the largest US cohort anymore, and that the prime working-age force is expected to start growing again in a few years. In other words, in terms of the demographic outlook, the dynamic points to stronger, rather than weaker, economic growth. By 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts will be the youngest 11 cohorts. (see the marvelous animation Bill has at the end of his post).

Not All Europe Is The Same

Naturally, demographic dynamics are not the same in every country across Europe. The two oldest countries on the planet are Japan and Germany with median population ages of around 46. Then comes Italy with with one of 45. I have recently written about the possibility Germany is bogged down in some kind of secular stagnation process. The Economist writer argues that what Europe's economies need are structural reforms, but it isn't clear if he also thinks Germany needs another swathe of these. Long term growth is low in Germany, and inflation pressures are weak. It is not clear, however, that Germany is stuck in any kind of any kind of balance-sheet-recession-type liquidity trap. Loan growth is low, but this may well be a function of the age structure of the population.

It's no big secret really that Italy is suffering long term growth stagnation (which many, like the Economist and Beppe Grillo simply attribute to Euro membership).

And Italy has recently begun to have negative inflation levels.

Next on the list come countries like Austria (median age, 44), Finland (43,2), The Netherlands (42.1), Switzerland (42) and Sweden (41.2). It is striking that both Finland and The Netherlands have recently been suffering from very weak growth and almost constant recessions, while Sweden and Switzerland have an ongoing problem with a deflation threat.

If we fan out a bit, and move over to Eastern Europe, where working age populations are almost universally falling, the sharp fall in growth rates between the years before and the years after the crisis is also pretty noteworthy.

Before the crisis annual growth rates were in the 4% to 6% range, now they are in the 1% to 2% range, and these are all emerging economies with levels of GDP per capital well below the EU average, countries who should in theory be experiencing strong "catch up" growth.

At the same time inflation, which was previously a significant problem, has all but disappeared and in fact deflation risk is pretty general across the region. Normally CEE countries have median ages of around 41, much older than say Ireland with a median age of 35.7, or the United States with one of 37.6.

So we seem to be observing the following pattern: working age population growth approaches zero and starts to turn negative, growth slumps to about 1% a year and falling, and inflation weakens to the point of becoming deflation. If this rough correlation is reasonably valid the next countries where we see secular stagnation setting in are South Korea and China, since working age populations are now in the process of turning there too.

A Simple Mechanism

So how do secular stagnation work? What's the mechanism? Well so far we have been offered two, one from Paul Krugman.

"To have more or less full employment, we need sufficient spending to make use of the economy’s potential. But one important component of spending, investment, is subject to the accelerator effect: the demand for new capital depends on the economy’s rate of growth, rather than the current level of output. So if growth slows due to a falloff in population growth, investment demand falls — potentially pushing the economy into a semi-permanent slump."A slowdown in the rate of increase in domestic demand leads to a slowdown in investment, and this double slowdown pushes the economy into a dependence on exports and very weak GDP growth. The first place this "underinvestment" phenomenon showed up was in Japan.

Then we have seen it in Germany.

And now the "German" phenomenon has spread to the rest of Europe.

The second pathway through which demographically driven secular stagnation operates was described by a group of IMF economists in a recent research paper: "Is Japan’s Population Aging Deflationary?" Lower demand from older populations (less credit growth) leads to oversupply and deflationary pressure. The first part of the paper abstract runs as follows:

"Japan has the most rapidly aging population in the world. This affects growth and fiscal sustainability, but the potential impact on inflation has been studied less. We use the IMF’s Global Integrated Fiscal and Monetary Model (GIMF) and find substantial deflationary pressures from aging, mainly from declining growth and falling land prices. Dissaving by the elderly makes matters worse as it leads to real exchange rate appreciation from the repatriation of foreign assets. The deflationary effects from aging are magnified by the large fiscal consolidation need."

So while there is no definitive answer at this point to the question whether or not what we are seeing is a creeping process of secular stagnation which will gradually spread from one economy to another as the respective working age populations start to contract, there is strong prima facie evidence that there may be, that the theory is worth examining and that the hypothesis should continue to be tested.

Postscript

The above arguments about why the Euro Area countries may have entered some sort of state of secular stagnation are developed in detail and at far greater length in my new book "Is The Euro Crisis Really Over? - will doing whatever it takes be enough" - on sale in various formats - including Kindle - at Amazon.

Saturday, October 18, 2014

Some thematic links: France, Ukraine, Russia, Japan, China, South Pacific

I've been collecting links for the past while, part of my ongoing research into some interesting topics. I thought I'd share some with you tonight.

Tuesday, September 23, 2014

Still here!

It has been a while, I know, but Demography Matters is still here. I've got the raw material for new posts in the works.

A question to you, our readers. What would you like to see? Are there any particular areas or regions of the world, perhaps, or any kind of themes? Leave your suggestions in the comments.

Thursday, June 26, 2014

On the longevity and extended health of Icarians, among others

Via the Washington Post I came across a 2012 article in The New York Times Magazine by Dan Buettner, "The Island Where People Forget to Die". In this article, Buettner highlights the longevity and good health of the inhabitants of Icaria, a small Greek island in the Aegean Sea several dozen kilometres away from the Anatolian mainland where the average inhabitant can expect to live a decade longer than the average American. While many factors seem to contribute to the Icarians' situation--an abundance of exercise, a healthy diet, and so on--it seems that all these individual elements are reinforced by Icarian society as a whole.

In the United States, when it comes to improving health, people tend to focus on exercise and what we put into our mouths — organic foods, omega-3’s, micronutrients. We spend nearly $30 billion a year on vitamins and supplements alone. Yet in Ikaria and the other places like it, diet only partly explained higher life expectancy. Exercise — at least the way we think of it, as willful, dutiful, physical activity — played a small role at best.

Social structure might turn out to be more important. In Sardinia, a cultural attitude that celebrated the elderly kept them engaged in the community and in extended-family homes until they were in their 100s. Studies have linked early retirement among some workers in industrialized economies to reduced life expectancy. In Okinawa, there’s none of this artificial punctuation of life. Instead, the notion of ikigai — “the reason for which you wake up in the morning” — suffuses people’s entire adult lives. It gets centenarians out of bed and out of the easy chair to teach karate, or to guide the village spiritually, or to pass down traditions to children. The Nicoyans in Costa Rica use the term plan de vida to describe a lifelong sense of purpose. As Dr. Robert Butler, the first director of the National Institute on Aging, once told me, being able to define your life meaning adds to your life expectancy.

[. . .]

If you pay careful attention to the way Ikarians have lived their lives, it appears that a dozen subtly powerful, mutually enhancing and pervasive factors are at work. It’s easy to get enough rest if no one else wakes up early and the village goes dead during afternoon naptime. It helps that the cheapest, most accessible foods are also the most healthful — and that your ancestors have spent centuries developing ways to make them taste good. It’s hard to get through the day in Ikaria without walking up 20 hills. You’re not likely to ever feel the existential pain of not belonging or even the simple stress of arriving late. Your community makes sure you’ll always have something to eat, but peer pressure will get you to contribute something too. You’re going to grow a garden, because that’s what your parents did, and that’s what your neighbors are doing. You’re less likely to be a victim of crime because everyone at once is a busybody and feels as if he’s being watched. At day’s end, you’ll share a cup of the seasonal herbal tea with your neighbor because that’s what he’s serving. Several glasses of wine may follow the tea, but you’ll drink them in the company of good friends. On Sunday, you’ll attend church, and you’ll fast before Orthodox feast days. Even if you’re antisocial, you’ll never be entirely alone. Your neighbors will cajole you out of your house for the village festival to eat your portion of goat meat.

Every one of these factors can be tied to longevity. That’s what the $70 billion diet industry and $20 billion health-club industry do in their efforts to persuade us that if we eat the right food or do the right workout, we’ll be healthier, lose weight and live longer. But these strategies rarely work. Not because they’re wrong-minded: it’s a good idea for people to do any of these healthful activities. The problem is, it’s difficult to change individual behaviors when community behaviors stay the same. In the United States, you can’t go to a movie, walk through the airport or buy cough medicine without being routed through a gantlet of candy bars, salty snacks and sugar-sweetened beverages. The processed-food industry spends more than $4 billion a year tempting us to eat. How do you combat that? Discipline is a good thing, but discipline is a muscle that fatigues. Sooner or later, most people cave in to relentless temptation.

This message was emphasized by an 2013 article in The Guardian by Andrew Anthony, based at least in part on the author's interviews with Buettner.

The phrase "blue zone" was first coined by [author Dan] Buettner's colleague, the Belgian demographer Michel Poulain. "He was drawing blue circles on a map in Sardinia and then referring to the area inside the circle as the blue zone," Buettner says. "When we started working together, I extended it to Okinawa, Costa Rica and Ikaria. If you Google it now, it's entered the lexicon as a demographically confirmed geographical area where people live measurably longer." So what does it take to qualify? "It's a variation," Buettner says. "It's either the highest centenarian rate, so the most centenarians per 1,000. Or it has the highest life expectancy at middle age."

All the blue zones are slightly austere environments where life has traditionally required hard work. But they also tend to be very social, and none more so than Ikaria. At the heart of the island's social scene is a series of 24-hour festivals, known as paniyiri, which all age groups attend. They last right through the night and the centrepieces are mass dances in which everyone – teenagers, parents, the elderly, young children – takes part. Kostas Sponsas tells me he no longer has the energy to go on until dawn. He will now usually take his leave by 2am.

One evening, the island's star violin player, whom we met at Gregoris Tsahas's favourite cafe, invites Buettner, me and several others back to his house to hear him play. He says he often grows exhausted while performing at festivals, but the energy and enthusiasm of the people keep him going. He plays some traditional folk tunes, full of passion and yearning and heart-rending beauty, and mentions with pride that Mikis Theodorakis, the composer of Zorba The Greek, was among the leftists exiled on the island in the late 1940s. Theodorakis later recalled the experience with pleasure. "How could this be?" he asked. "The answer is simple: it's the beauty of the island in combination with the warmth of the locals. They risked their lives to be generous to us, something that helped us more than anything bear the burden of the hardship."

One of the things Buettner has found that unites the elderly inhabitants of all the blue zones is that they are unintentionally old: they didn't set out to extend their lives. "Longevity happened to these people," he says. "The centenarians didn't all of a sudden at 40 say, 'I'm going to become 100; I'm going to start getting exercise and eating these ingredients.' It ensues from their surroundings. So my argument is that the environmental components of places such as Ikaria are portable if you pay attention. And the value proposition in the real world is maybe a decade more life expectancy. It's not living to 100. But I think the real benefit is that the same things that yield this healthy longevity also yield happiness."

I ask a number of men in their 90s and 100s if they do any keep-fit exercise. The answer is always the same: "Yes, digging the earth." Nikos Fountoulis, for example, is a 93-year-old who looks 20 years younger. He still has a smallholding in the hills of the island's interior. Each morning he goes out at 8am to feed his animals and tend his garden. He used to dig charcoal as a younger man. "I never thought about getting old," he says. "I feel good. I feel 93, but on Ikaria that's OK."

Long-time readers of Demography Matters may remember that I visited the phenomenon of extended life expectancy and relatively gentle aging before, in a February 2010 post taking a look at the position and numbers of the aged in Abkhazia. Fantastic claims that Abkhazians regularly lived past the century mark have been debunked. Conversely, traditional Abkhazian culture does seem to have not only promoted good health, but helped integrate aging Abkhaz into their society in a way that allowed them to continue to be productive. (I know nothing about the current situation in Abkhazia. Anyone informed on this subject, please advise in the comments.)

Is it possible to learn from the lessons of Icarians and similar populations? Maybe. As commented in the articles I linked to above, Icarians' longevity appears to be the product of a complex mesh of social factors that can't be easily replicated. Whether the relaxed lifestyle of Icarians and others can be replicated in our contemporary world is very open to question, for instance. If nothing else, the Icarian experience does provide fascinating hints towards a possible futuree.

Wednesday, June 18, 2014

Secular Stagnation Part II - On Bubble Business Bound

"I now suspect that the kind of moderate economic policy regime...... that by and large lets markets work, but in which the government is ready both to rein in excesses and fight slumps – is inherently unstable."

Paul Krugman - The Instability of Moderation

"Conventional macreconomic theory leaves us in a very serious problem, because we all seem to agree that whereas you can keep the federal funds rate at a low level forever it's much harder to do extraordinary measures that go beyond that forever. But the underlying problem may be there forever. It's much more difficult to say, well we only needed deficits during the short period of the crisis if equilibrium interest rates can't be achieved given the prevailing rate of inflation."

Larry Summers - IMF 14th Annual Research Conference In Honor Of Stanley Fisher,

Discussion surrounding the Larry Summers speech to the autumn 2013 IMF research conference (text here) - where he suggested that what we might be observing in developed economies is a phenomenon similar to that which Alvin Hansen (writing in the 1930s) termed secular stagnation (see eg here) - has been intense, raising a plethora of issues, among them whether or not modern developed economies NEED to continually generate bubbles to sustain growth.

Naturally one part of the debate currently taking place revolves around whether or not secular stagnation exists at all. Here I think we can safely leave the heavy lifting part of the argument to Messrs Krugman, Summers et al who will through their ongoing work continue to defend the "aye" corner. The issue, at the end of the day is going to be an empirically testable one, even if - in a discursive space where rival world views are constantly in play - things are never, ever, quite that simple.

Permanent Fiscal Stimulus?

But there is another, equally important, part to this problem. Suppose for a moment that the secular stagnation thesis is a valid one, and suppose - as I argue in the introduction to this series - that the phenomenon is the result of a slowdown in the rate of growth (turning eventually into contraction) in working age populations in one country after another. Then add to this the further supposition that the process is ongoing (ie not the product of a "baby boom" generation or any such similar "one off") and effectively irreversible.

If these three suppositions jointly and severely satisfy the minimum conditions necessary to warrant their being explored, then we have to face the possibility - as Larry Summers does (and as Eggertsson and Mehrotra attempt to do via the elavoration of a model) - that the conditions might be given whereby what is called the "natural" (or equilibrium) rate of interest gets stuck in permanently negative territory and and thus become - to all intent and purpose - permanently out of reach. So, asks Larry, how can we justify the fiscal deficits we run as being purely counter-cyclical? Or, as Paul Krugman puts it after reading the Eggertsson and Mehrotra paper, "I’m wondering in particular whether there is a possibility of sustaining the economy with permanent fiscal expansion".

Larry Summers doesn't go quite so far. In an article in the Financial Times - Why stagnation might prove to be the new normal - he recognizes there is a risk of producing bubbles when there is a continuous and unending application of non-conventional measures, but then, somehow, he seems to duck the bigger question: namely what can realistically be achieved and at what cost. Rather than the issue being - as presented by Keynes (see my intro to this series) - how we manage the consequences of inevitable population decline, Summers asks us to think about "how we manage an economy in which the zero nominal interest rate is a chronic and systemic inhibitor of economic activity holding our economies back below their potential".

Naturally, there are assumptions here - large ones - that need to be thought about. Do developed economies really have a growth potential, above and beyond that which is already being manifested. How do we know that? How can we confirm or deny the hypothesis? How can we be sure that long term growth potential is not simply being systematically negatively reduced by the decline in working age populations?

At the very minimum we are in need of one positive counter example, one which shows that there is an underlying potential waiting to be unleashed.

Today's Situation Very Different From 1930s

The current situation is very different from the one John Maynard Keynes contemplated in the 1930s in his General Theory. At that point in the evolution of our economies and our societies the more advanced economies were stuck in a long lasting depression, a depression whose general dynamics are still far from being adequately understood, but one which was at least partly being perpetuated by the ineffectiveness of monetary policy due to the presence of a liquidity trap. The problem at that time was not simply cyclical, and certainly attempts to address it offer pointers to how we can handle our present day one. But the 1930s problem was not not in-principle self perpetuating. Economies really were being held back, as subsequent history has shown.

Today many economies are suffering the effects of a liquidity trap, but this time what we have is not simply a transient phenomenon since that trap is being generated by the impact of long term demographic changes in a way which was not the case in the 1930s - indeed you could speculate that in some countries the liquidity trap is a by-product of being stuck in a low fertility one. So the temporary application of exceptional fiscal and liquidity measures isn't going to resolve the "problem" (if problem - as opposed to inevitable and natural evolution in our economic and demographic regimes - there be) since once the effects of these wear off the economy may simply return to its old lethargy. This outcome I fear is one we will see in Japan if the Abenomics stimulus is ever removed.

Thus we are not simply talking about what Keynes referred to in his Essays in Persuasion as "magneto trouble" (despite this being one of PK's favourite analogies), wherein "the economic engine was as powerful as ever — but one crucial part [the magneto]was malfunctioning, and needed to be fixed". Which, we may ask, is the component which needs to be "fixed" here - I reiterate - could it possibly be fertility?

That's why people are talking about permanent fiscal stimulus, assuming "stimulus" is the appropriate word here. If it is then the definition of "austerity" transits into "failure to apply permanent fiscal stimulus". It's a new and different world, one where there is no "back" to head for, or as the American writer Thomas Wolf put it, "you can look homeward, angel", but "you can't go home again".

And Permanently Rising Sovereign Debt?

So to take the standard case, Japan, we might like to ask ourselves what the risks involved in carrying out such permanent stimulus actually are. Curiously the worry here isn't the standard one, hyperinflation. The Bank of Japan and the Ministry of Finance are pumping large amounts of "juice" into the economy, but trend growth is only being sustained at something just over 1% per annum, and outside periods of rapid yen devaluation or consumption tax hikes there is little to be seen in the way of demand led inflation.

The BoJ is currently buying virtually all new issue Japan Government Bonds (holding in doing so the interest rate on 10yr debt at around 0.6%) and the MoF is funding something like 10% of GDP in annual deficit spending by selling bonds to the central bank.

Despite such strong policy measures, the only incontestable negative that stands out is the accumulation of a lot of government debt. In the Japanese case, and to date, it amounts to something like 245% of GDP. Obviously such a high level of sovereign indebtedness commands respect, but is it really, really problematic? Paul Krugman isn't convinced. As he tells us in his article "The Japan Story" (2013), "while there is much shaking of heads about Japanese debt, the ill-effects if any of that debt are by no means obvious."

Time Out With MMT

In fact there is a whole school of thought - known by the name of Modern Monetary Theory - which would argue that the ill effects are not obvious since they don't really exist. It's just a question of keystrokes. I don't consider myself any kind of expert on the doctrines of MMT, but this critique of Paul Krugman and Larry Summers by blogger Ralph Musgrave seems to be reasonably representative of the general line of thought.

On occasion Paul has been rather dismissive of MMT writings, but the thing is his principal objection has normally been that the implementation of their approach would lead to - wait for it - inflation. Now this tack is not so surprising since it used to be the accepted basis for any mainstream critique of systematic money printing. But here's the rub, right now we seem incapable of generating systematic inflation. Not only that PK himself has been fiercely critical - and with reason - of those who had been predicting we were. In fact most of Paul's critique of MMT seems to date to an epoch before we started to ask ourselves whether the natural rate of interest might not have turned permanently negative. As he said, in a critique of MMT made back in March 2011:

Why Then Is There A Risk Of Bubbles?

The characteristics of liquidity traps are well known. Central banks increase their balance sheets (M1, base money) but this increase fails to feed through either to expansions in broader money indicators (M3, credit to the private sector), or to real economic activity (employment, consumption) or even to inflation.

When their balance sheets are leveraged in a more targeted sense, such as in programmes to promote specific sectors of bank lending, the risk of sectoral mini bubbles increases, as we are currently seeing in the UK.

I won't go into all this more here, since I have recently written extensively on the topic (see the Hot Labour Phenomenon), but it seems clear that a lot of the liquidity which is being pumped into the system by the ECB in an attempt to reflate economies on the Euro periphery is in fact arriving in cities like London, Berlin and Geneva (and specifically their housing sectors) producing all sorts of "bubbly" type activity and distortions in the domestic economies of the countries concerned, distortions which will prove hard to correct later, and may become highly negative in their effect should they eventually unwind.

All this liquidity may not have helped restore the real economies in the intended recipient countries, but it certainly - via "carry trades" and suchlike - made its presence felt elsewhere. Emerging market economies like India, Turkey, Brazil, Indonesia and South Africa saw their economies on the receiving end of large quantities of short term inward fund flows, flows which pushed the values of their currency strongly upwards, overheated the domestic economies with credit and generated long lasting distortions.

Naturally, when the US Federal Reserve started to talk about tapering its bond purchases (in May 2013) the impact was felt in one emerging economy after another across the globe, as funds suddenly began to flow out, and the values of the respective currencies suddenly started to fall sharply.

So you can understand Reserve Bank of India governor Raghuram Rajan's frustration when he went to Frankfurt last year and complained to his audience: "We seem to be in a situation where we are doomed to inflate bubbles elsewhere." As Larry Summers notes in his Financial Times article: "In the past decade, before the crisis, bubbles and loose credit were only sufficient to drive moderate growth". What one might ask will be needed to achieve that "moderate growth" outcome this time round?

Paul Krugman - The Instability of Moderation

"Conventional macreconomic theory leaves us in a very serious problem, because we all seem to agree that whereas you can keep the federal funds rate at a low level forever it's much harder to do extraordinary measures that go beyond that forever. But the underlying problem may be there forever. It's much more difficult to say, well we only needed deficits during the short period of the crisis if equilibrium interest rates can't be achieved given the prevailing rate of inflation."

Larry Summers - IMF 14th Annual Research Conference In Honor Of Stanley Fisher,

Discussion surrounding the Larry Summers speech to the autumn 2013 IMF research conference (text here) - where he suggested that what we might be observing in developed economies is a phenomenon similar to that which Alvin Hansen (writing in the 1930s) termed secular stagnation (see eg here) - has been intense, raising a plethora of issues, among them whether or not modern developed economies NEED to continually generate bubbles to sustain growth.

Naturally one part of the debate currently taking place revolves around whether or not secular stagnation exists at all. Here I think we can safely leave the heavy lifting part of the argument to Messrs Krugman, Summers et al who will through their ongoing work continue to defend the "aye" corner. The issue, at the end of the day is going to be an empirically testable one, even if - in a discursive space where rival world views are constantly in play - things are never, ever, quite that simple.

Permanent Fiscal Stimulus?

But there is another, equally important, part to this problem. Suppose for a moment that the secular stagnation thesis is a valid one, and suppose - as I argue in the introduction to this series - that the phenomenon is the result of a slowdown in the rate of growth (turning eventually into contraction) in working age populations in one country after another. Then add to this the further supposition that the process is ongoing (ie not the product of a "baby boom" generation or any such similar "one off") and effectively irreversible.

If these three suppositions jointly and severely satisfy the minimum conditions necessary to warrant their being explored, then we have to face the possibility - as Larry Summers does (and as Eggertsson and Mehrotra attempt to do via the elavoration of a model) - that the conditions might be given whereby what is called the "natural" (or equilibrium) rate of interest gets stuck in permanently negative territory and and thus become - to all intent and purpose - permanently out of reach. So, asks Larry, how can we justify the fiscal deficits we run as being purely counter-cyclical? Or, as Paul Krugman puts it after reading the Eggertsson and Mehrotra paper, "I’m wondering in particular whether there is a possibility of sustaining the economy with permanent fiscal expansion".

Larry Summers doesn't go quite so far. In an article in the Financial Times - Why stagnation might prove to be the new normal - he recognizes there is a risk of producing bubbles when there is a continuous and unending application of non-conventional measures, but then, somehow, he seems to duck the bigger question: namely what can realistically be achieved and at what cost. Rather than the issue being - as presented by Keynes (see my intro to this series) - how we manage the consequences of inevitable population decline, Summers asks us to think about "how we manage an economy in which the zero nominal interest rate is a chronic and systemic inhibitor of economic activity holding our economies back below their potential".

Naturally, there are assumptions here - large ones - that need to be thought about. Do developed economies really have a growth potential, above and beyond that which is already being manifested. How do we know that? How can we confirm or deny the hypothesis? How can we be sure that long term growth potential is not simply being systematically negatively reduced by the decline in working age populations?

At the very minimum we are in need of one positive counter example, one which shows that there is an underlying potential waiting to be unleashed.

Today's Situation Very Different From 1930s

The current situation is very different from the one John Maynard Keynes contemplated in the 1930s in his General Theory. At that point in the evolution of our economies and our societies the more advanced economies were stuck in a long lasting depression, a depression whose general dynamics are still far from being adequately understood, but one which was at least partly being perpetuated by the ineffectiveness of monetary policy due to the presence of a liquidity trap. The problem at that time was not simply cyclical, and certainly attempts to address it offer pointers to how we can handle our present day one. But the 1930s problem was not not in-principle self perpetuating. Economies really were being held back, as subsequent history has shown.

Today many economies are suffering the effects of a liquidity trap, but this time what we have is not simply a transient phenomenon since that trap is being generated by the impact of long term demographic changes in a way which was not the case in the 1930s - indeed you could speculate that in some countries the liquidity trap is a by-product of being stuck in a low fertility one. So the temporary application of exceptional fiscal and liquidity measures isn't going to resolve the "problem" (if problem - as opposed to inevitable and natural evolution in our economic and demographic regimes - there be) since once the effects of these wear off the economy may simply return to its old lethargy. This outcome I fear is one we will see in Japan if the Abenomics stimulus is ever removed.

Thus we are not simply talking about what Keynes referred to in his Essays in Persuasion as "magneto trouble" (despite this being one of PK's favourite analogies), wherein "the economic engine was as powerful as ever — but one crucial part [the magneto]was malfunctioning, and needed to be fixed". Which, we may ask, is the component which needs to be "fixed" here - I reiterate - could it possibly be fertility?

That's why people are talking about permanent fiscal stimulus, assuming "stimulus" is the appropriate word here. If it is then the definition of "austerity" transits into "failure to apply permanent fiscal stimulus". It's a new and different world, one where there is no "back" to head for, or as the American writer Thomas Wolf put it, "you can look homeward, angel", but "you can't go home again".

And Permanently Rising Sovereign Debt?

So to take the standard case, Japan, we might like to ask ourselves what the risks involved in carrying out such permanent stimulus actually are. Curiously the worry here isn't the standard one, hyperinflation. The Bank of Japan and the Ministry of Finance are pumping large amounts of "juice" into the economy, but trend growth is only being sustained at something just over 1% per annum, and outside periods of rapid yen devaluation or consumption tax hikes there is little to be seen in the way of demand led inflation.

The BoJ is currently buying virtually all new issue Japan Government Bonds (holding in doing so the interest rate on 10yr debt at around 0.6%) and the MoF is funding something like 10% of GDP in annual deficit spending by selling bonds to the central bank.

Despite such strong policy measures, the only incontestable negative that stands out is the accumulation of a lot of government debt. In the Japanese case, and to date, it amounts to something like 245% of GDP. Obviously such a high level of sovereign indebtedness commands respect, but is it really, really problematic? Paul Krugman isn't convinced. As he tells us in his article "The Japan Story" (2013), "while there is much shaking of heads about Japanese debt, the ill-effects if any of that debt are by no means obvious."

Time Out With MMT

In fact there is a whole school of thought - known by the name of Modern Monetary Theory - which would argue that the ill effects are not obvious since they don't really exist. It's just a question of keystrokes. I don't consider myself any kind of expert on the doctrines of MMT, but this critique of Paul Krugman and Larry Summers by blogger Ralph Musgrave seems to be reasonably representative of the general line of thought.

On occasion Paul has been rather dismissive of MMT writings, but the thing is his principal objection has normally been that the implementation of their approach would lead to - wait for it - inflation. Now this tack is not so surprising since it used to be the accepted basis for any mainstream critique of systematic money printing. But here's the rub, right now we seem incapable of generating systematic inflation. Not only that PK himself has been fiercely critical - and with reason - of those who had been predicting we were. In fact most of Paul's critique of MMT seems to date to an epoch before we started to ask ourselves whether the natural rate of interest might not have turned permanently negative. As he said, in a critique of MMT made back in March 2011:

"The key thing to remember is that current conditions — lots of excess capacity in the economy, and a liquidity trap in which short-term government debt carries a roughly zero interest rate — won’t always prevail. As long as those conditions DO prevail, it doesn’t matter how much the Fed increases the monetary base, and it therefore doesn’t matter how much of the deficit is monetized. But this too shall pass, and when it does, things will be very different."It's the "won't always prevail" bit which grabbed my attention. Now it is clear we are contemplating the possibility that it might, in which case the August 2011 observation that:

"the MMT people are just wrong in believing that the only question you need to ask about the budget deficit is whether it supplies the right amount of aggregate demand; financeability matters too, even with fiat money."would seem to be no longer valid, either that or it is highly relevant to the discussion about whether or not Japan government debt really is so benign. I think you can't have it both ways. For my part I'm not at all sure PK is right in being so complacent about Japan debt, and indeed I have explored some of the possible Japan end-games with Claus Vistesen in our piece Japan's Looming Singularity. But even beyond potential financeability problems (eg just how deep into negative territory can you take a central bank balance sheet and live to tell the tale), there are other more traditional problems which arise, especially if the supplier for the newly induced aggregate demand lies outside the borders of your economy leading the current account balance to go west (see my "The Growing Mess Which Will Be Left Behind By The Abenomics Experiment").

Why Then Is There A Risk Of Bubbles?

The characteristics of liquidity traps are well known. Central banks increase their balance sheets (M1, base money) but this increase fails to feed through either to expansions in broader money indicators (M3, credit to the private sector), or to real economic activity (employment, consumption) or even to inflation.

When their balance sheets are leveraged in a more targeted sense, such as in programmes to promote specific sectors of bank lending, the risk of sectoral mini bubbles increases, as we are currently seeing in the UK.

I won't go into all this more here, since I have recently written extensively on the topic (see the Hot Labour Phenomenon), but it seems clear that a lot of the liquidity which is being pumped into the system by the ECB in an attempt to reflate economies on the Euro periphery is in fact arriving in cities like London, Berlin and Geneva (and specifically their housing sectors) producing all sorts of "bubbly" type activity and distortions in the domestic economies of the countries concerned, distortions which will prove hard to correct later, and may become highly negative in their effect should they eventually unwind.

All this liquidity may not have helped restore the real economies in the intended recipient countries, but it certainly - via "carry trades" and suchlike - made its presence felt elsewhere. Emerging market economies like India, Turkey, Brazil, Indonesia and South Africa saw their economies on the receiving end of large quantities of short term inward fund flows, flows which pushed the values of their currency strongly upwards, overheated the domestic economies with credit and generated long lasting distortions.

Naturally, when the US Federal Reserve started to talk about tapering its bond purchases (in May 2013) the impact was felt in one emerging economy after another across the globe, as funds suddenly began to flow out, and the values of the respective currencies suddenly started to fall sharply.

Sunday, June 15, 2014

The "Hot Labour" Phenomenon

Strong growth. Rising real estate prices. Rapid job creation. Surging immigration. This list sums up the Switzerland of 2014 down to a tee. However, it also sounds like a description of what things were like in Spain in 2007 - shortly before the country's economy fell off a cliff. What follows is a conversation between financial journalist Detlef Gürtler and economist and crisis expert Edward Hugh about possible parallels and differences between the two booms, and the role of a new phenomenon which Hugh describes as "Hot Labour".

Hugh argues that this is a new phenomenon, and on the increase as a result of central bank bubble inducing activity. While immigration is a vital tool aiding economies to manage the population ageing process, it is important that economic activities be balanced. Immigration fueling boom/bust cycles is far from innocuous, and harm a country just as much as a sudden stop in capital flows if the immigration is followed by emigration.

Detlef Gürtler: Well Edward, you personally lived through one of the most important real estate booms in European history - the recent Spanish one. Is the real estate boom we are witnessing in Switzerland in any way comparable?

Edward Hugh: Before I start, I think it's worth pointing out that it goes without saying the Swiss are quite different from the Spaniards; and the Swiss economy is completely different from the Spanish one. In this sense every boom or crisis is in its own way different from anything before. That said, such "trivia" doesn't normally stop economists like me from trying to draw comparisons, even if in this case I have to be extremely careful, since while I know quite a lot about Spain I know much less about Switzerland. So perhaps you will help me.

Detlef Gürtler: Yes, economists do make comparisons, and you were even so bold as to draw one between the German 1990s housing boom and the one which took place in Spain after the start of the century.

Edward Hugh: Well this comparison isn't so strange as it may seem. Many talk today about Spain becoming the new Germany - in the sense of an export powerhouse - and while this idea may have a rather dubious basis in reality the shift from domestic consumption to exports is quite striking.

In both cases the subsequent "regeneration" was preceded by a significant consumer boom, in both cases there was a strong increase in real estate prices including a construction boom, in both cases there was an increase in household indebtedness, in both cases the current account deficit deteriorated. And then in both cases there was a rude awakening. The only real difference was one of scale, and in this case scale is important. Spain had what was at the end of the day the mother of all housing bubbles.

Detlef Gürtler: But in each case there was a completely different historical background and there were very different underlying motifs.

Edward Hugh: Yes, of course. But does that really make a difference when it comes to economic ambition? East Germany's citizens in 1992 - just like their Spanish equivalents in 2002 - saw how big the distance was between their consumption level and the western (or northern) one, and since they could in each case contract debt on what was for them fairly favorable terms they decided to put history straight and to carry out a rapid catch up in consumption. Really, Europe as a democratic political project has some of the responsibility here, since there was no equalizing mechanism put in place, but at the same time people felt they were entitled to similar living standards.

One of the new MEPs from the newly formed Podemos party put it like this in a recent interview: "they have sold us a system in which they told us we would all be rich and we were all going to live very well, and there was a period like that, but all that’s over now."

Detlef Gürtler: The Germans, on the other hand didn't find themselves with mortgages well below the actual value of the relevant property, while Spaniards are already facing this problem.

Edward Hugh: No, you're right, but this isn't the whole picture. Weren't there massive tax breaks for builders and developers in East Germany, tax breaks which were rapidly converted into 100% financing whereby the government effectively assumed the cost of write-down?.

Detlef Gürtler: Only in the prospectuses of tax-saving-scheme promoters. In fact, many investors ultimately remained sitting on a mountain of debt, debt which was higher than the long-term obtainable sale price for the property.

Edward Hugh: I see. In Spain, instead, creative valuation techniques were used. The economic end result is the same: you lose the property but get stuck with a large part of the debt.

Detlef Gürtler: And how does Switzerland fits into this picture?

Edward Hugh: Well lets start with something which at face value seems positive. For many years there was virtually no inflation in Switzerland, sometimes the situation was more like deflation. Now a bubble economy without inflation, surely that would seem to be a novelty.

Unfortunately, when you come to look into things a bit more it isn't quite the novelty it seems to be. In fact Larry Summers, in his secular stagnation speech to the IMF 2013 research conference drew attention to this phenomenon.

Detlef Gürtler: But if we look at real estate itself we see a different picture. In many market segments show annual price increases of more than ten percent.

Edward Hugh: Well, that is presumably in no small part due to investors from around the world seeking a safe haven for their money in Switzerland.

Detlef Gürtler: Yes. But especially since the franc was coupled to the euro these investors switched from the Swiss currency into Swiss real estate.

Edward Hugh: And obviously this increase is not (or is only insufficiently) taken into account in the consumer price inflation rate. Here again we find a similarity with Spain where the large rise in house prices was not reflected at all in the official consumer inflation rate. So despite official price stability life feels like it is becoming significantly more expensive, especially for those looking for a new apartment.

Normally when addressing the question of whether a real estate bubble exists or not, it is important to think about leveraging, about whether the home purchases are financed by credit. If real houses are paid for with real money paid, and this money comes from the outside, the economic effect could be seen as more economically similar to exports: A foreigner buys a piece Switzerland. If the price falls back, it is largely a problem for the external investor, not for the Swiss themselves or the Swiss banks.

On the other hand, if all this "speculative" activity drives up property prices in a deflationary environment where wages are stationary, the affordability problem creates a different issue for Swiss nationals.

Detlef Gürtler: And what about the British market? Would you say this is currently more driven by "irrational exuberance" than Switzerland ?

Edward Hugh: Great Britain has at the present time the fastest growing economy among all industrialized countries. But why should Britain suddenly have become a stellar economy, an exceptional out-performer? Again all this euphoria in the UK really reminds me of Spain, since Spain in its day was also considered to be an "out-performer", experiencing a major economic miracle.

London house prices are up 18% year on year, and the current account balance is worsening. At the moment national insurance data indicate that roughly 600,000 economic migrants are arriving in the UK annually. Not as many as in Spain during the boom times - either in absolute terms or proportionally - but still a significant number. Because the immigration is mainly focused on London, it is leading to large distortions which affect the whole economy. The new arrivals need homes, but naturally they start without work and are not looking to buy. They end up renting - in maybe groups of 3 or 4 - and are thus able to collectively pay rental prices which a normal family cannot afford. Hence the buy to rent business become interesting.

Sadly many of the young Spaniards arriving (maybe 60,000 a year) are fleeing the consequences of one bubble only to inadvertently fuel another.

Detlef Gürtler: But isn't this an example of exactly the kind of labour mobility the EU in general and (the euro zone in particular) wanted to see? People move from countries and regions were there is little work to those where there is plenty? This pattern of behavior was legendary in the USA. Isn't it good that it now comes to Europe?

Edward Hugh: Well, yes and no. The key point is that the employment growth needs to be sustainable. Look at Spain, nearly half a million former immigrants left the country last year. And yet one more time it is important to understand that Euro Area countries have a different set of institutional arrangements to the ones which apply to US states. When Detroit went bust, the Federal Government was there to act as backstop.

When such activity is not sustainable there is a self perpetuating component which is highly undesirable. As Londoners feel better off since the value of their home has risen the borrow and spend more. They become more leveraged. This boost to economic activity in turn attracts new immigrants, which push up rents even further and with them property values, making Londoners feel even richer, and so on. As a result you get what you could call an unbalanced but self-reinforcing economic recovery. Hence the "superstar economy" aspect.

So the point is that while developed economy societies need positive migration flows as they age, they don't need just any old kind of flow, otherwise you could end up with problem bigger than the one you started with.