Strangely, while I would suggest the most obviously affected countries are those mentioned above, most of the debate has centered around the US economy. Since it is not at all clear that the US economy is actually suffering from either a liquidity trap or secular stagnation at this point, this has lead many to question whether the idea might not be ill-founded. The Economist, for example, in a revue article (Vox e-book on the topic conclude the concept "remains a baggy one", one which is "arguably too capacious for its own good".

Viewed in this light the concept does at times appear vague, and lacking in clear definition. In part this is because Alvin Hansen's original idea was made up of two components, a technological and a demographic one. Naturally if there is a slowdown in the rate of impact of technological innovation then this would be felt equally across those economies which are operating near the technological frontier. But the phenomenon which is being described today as secular stagnation isn't being witnessed equally across all those countries. Economies in both the UK and the US appear to have responded differently to those in Sweden, the Euro Area and Japan, a phenomenon which is obvious to the theory's critics. Thus the Economist author goes on to argue, "it is hard to avoid the conclusion that many of the euro area’s difficulties result from a dysfunctional monetary union rather than a susceptibility to secular stagnation." And it would be hard to disagree with the writer, except... except ....except that there is the awkward little case of Japan, which doesn't actually use the Euro, as there are possible cases like the Czech Republic, Sweden or Hungary that don't either.

Which brings us nearer to the demographic part of the argument. Is there any pattern emerging in the way symptoms which look like those which would be presented in cases suffering from secular stagnation are showing up? Well, I would argue there is. I think it is generally accepted that the first affected country was Japan. It was in Japan that a slowdown in GDP growth (not GDP per capita growth) was first noted.

Japan was also the first country were working age population started to turn negative (in 1997) and where the correlation between declining growth momentum in this group and creeping deflation first started to be noticed.

Here's what movements in EU working age population look like.

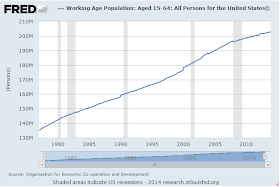

And here's why I don't think considerations of demography can really justify the secular stagnation thesis in the United States context at the present time.

EU working age populations started to decline in the years between 2009 and 2012. They will now continue to decline for many years to come. In the United States however, while the rate of growth in this population segment has slowed in recent years, it is about to start accelerating again. As Calculated Risk's Bill McBride pointed out, the US Census Bureau now reports that Baby Boomers aren't the largest US cohort anymore, and that the prime working-age force is expected to start growing again in a few years. In other words, in terms of the demographic outlook, the dynamic points to stronger, rather than weaker, economic growth. By 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts will be the youngest 11 cohorts. (see the marvelous animation Bill has at the end of his post).

Not All Europe Is The Same

Naturally, demographic dynamics are not the same in every country across Europe. The two oldest countries on the planet are Japan and Germany with median population ages of around 46. Then comes Italy with with one of 45. I have recently written about the possibility Germany is bogged down in some kind of secular stagnation process. The Economist writer argues that what Europe's economies need are structural reforms, but it isn't clear if he also thinks Germany needs another swathe of these. Long term growth is low in Germany, and inflation pressures are weak. It is not clear, however, that Germany is stuck in any kind of any kind of balance-sheet-recession-type liquidity trap. Loan growth is low, but this may well be a function of the age structure of the population.

It's no big secret really that Italy is suffering long term growth stagnation (which many, like the Economist and Beppe Grillo simply attribute to Euro membership).

And Italy has recently begun to have negative inflation levels.

Next on the list come countries like Austria (median age, 44), Finland (43,2), The Netherlands (42.1), Switzerland (42) and Sweden (41.2). It is striking that both Finland and The Netherlands have recently been suffering from very weak growth and almost constant recessions, while Sweden and Switzerland have an ongoing problem with a deflation threat.

If we fan out a bit, and move over to Eastern Europe, where working age populations are almost universally falling, the sharp fall in growth rates between the years before and the years after the crisis is also pretty noteworthy.

Before the crisis annual growth rates were in the 4% to 6% range, now they are in the 1% to 2% range, and these are all emerging economies with levels of GDP per capital well below the EU average, countries who should in theory be experiencing strong "catch up" growth.

At the same time inflation, which was previously a significant problem, has all but disappeared and in fact deflation risk is pretty general across the region. Normally CEE countries have median ages of around 41, much older than say Ireland with a median age of 35.7, or the United States with one of 37.6.

So we seem to be observing the following pattern: working age population growth approaches zero and starts to turn negative, growth slumps to about 1% a year and falling, and inflation weakens to the point of becoming deflation. If this rough correlation is reasonably valid the next countries where we see secular stagnation setting in are South Korea and China, since working age populations are now in the process of turning there too.

A Simple Mechanism

So how do secular stagnation work? What's the mechanism? Well so far we have been offered two, one from Paul Krugman.

"To have more or less full employment, we need sufficient spending to make use of the economy’s potential. But one important component of spending, investment, is subject to the accelerator effect: the demand for new capital depends on the economy’s rate of growth, rather than the current level of output. So if growth slows due to a falloff in population growth, investment demand falls — potentially pushing the economy into a semi-permanent slump."A slowdown in the rate of increase in domestic demand leads to a slowdown in investment, and this double slowdown pushes the economy into a dependence on exports and very weak GDP growth. The first place this "underinvestment" phenomenon showed up was in Japan.

Then we have seen it in Germany.

And now the "German" phenomenon has spread to the rest of Europe.

The second pathway through which demographically driven secular stagnation operates was described by a group of IMF economists in a recent research paper: "Is Japan’s Population Aging Deflationary?" Lower demand from older populations (less credit growth) leads to oversupply and deflationary pressure. The first part of the paper abstract runs as follows:

"Japan has the most rapidly aging population in the world. This affects growth and fiscal sustainability, but the potential impact on inflation has been studied less. We use the IMF’s Global Integrated Fiscal and Monetary Model (GIMF) and find substantial deflationary pressures from aging, mainly from declining growth and falling land prices. Dissaving by the elderly makes matters worse as it leads to real exchange rate appreciation from the repatriation of foreign assets. The deflationary effects from aging are magnified by the large fiscal consolidation need."

So while there is no definitive answer at this point to the question whether or not what we are seeing is a creeping process of secular stagnation which will gradually spread from one economy to another as the respective working age populations start to contract, there is strong prima facie evidence that there may be, that the theory is worth examining and that the hypothesis should continue to be tested.

Postscript

The above arguments about why the Euro Area countries may have entered some sort of state of secular stagnation are developed in detail and at far greater length in my new book "Is The Euro Crisis Really Over? - will doing whatever it takes be enough" - on sale in various formats - including Kindle - at Amazon.